colorado electric vehicle tax rebate

Contact the Colorado Department of Revenue at 3032387378. Email the Technical Response Service or call 800-254-6735.

State Electric Vehicle Tax Credits Electric Hybrid Alternative For 2022

Maine electric vehicle rebates.

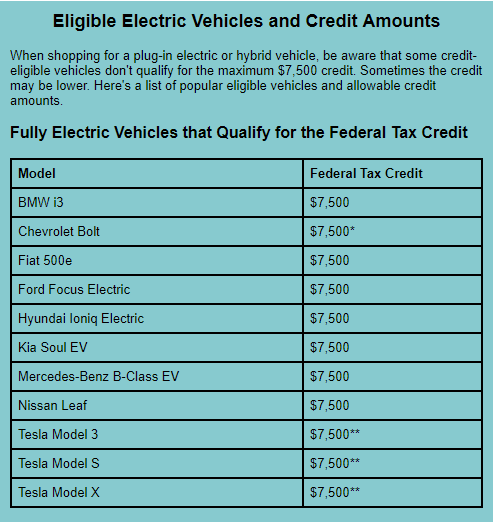

. Colorado residents are able to claim an additional state tax credit of 2500 when they buy an electric vehicle. INCOME-QUALIFIED ELECTRIC VEHICLE REBATE. 421 rows All-electric and plug-in hybrid cars purchased new in or after 2010 may be eligible for a federal income tax credit of up to 7500.

Light-duty EVs purchased or leased before January 1. The Colorado Department of Transportation CDOT is authorized to issue grants loans and rebates through the Clean Transit Enterprise Enterprise a government-owned business to. If you lease cars or trucks for your business you also qualify for the Colorado electric-vehicle tax credit under Income 69.

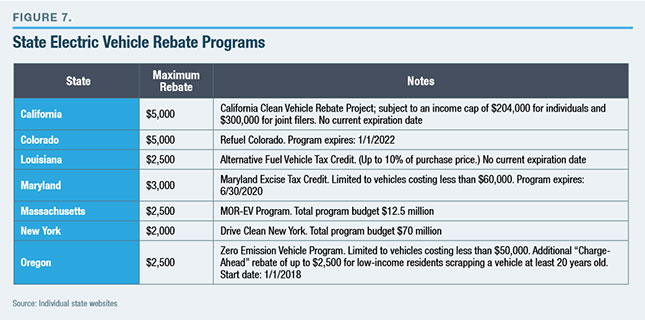

Maryland offers a tax credit up to 3000 for qualified. Xcels new vehicle lease or purchase rebates are richer than Colorados state new EV tax credit which in 2021 fell to 2500 per vehicle Sobczak noted. Save up to 5500 on an Electric Vehicle EV Income-qualified customers can receive 3000 off a used or 5500 off a new EV when you.

Low Emission Vehicle LEV. The credits decrease every. Tax credits are available in Colorado for the purchase or lease of electric vehicles and plug-in hybrid electric vehicles.

While Colorado does not have an electric vehicle rebate the state offers tax credits for the purchase or lease of an electric vehicle EV of up to 3500. A 5500 rebate on a new electric car and a 3000 rebate on. This page provides information to assist residents in understanding how EVs work what car models are available costs and incentives and how to charge at home and around town.

So weve got 5500 off. Many Coloradans may be eligible for the Property TaxRentHeat Credit rebate also known as the PTC Rebate which is available every year. But not the state tax credit.

The rebates which are on top of any state or federal tax credits have been popular said Michelle Aguayo an Xcel spokeswoman. Showed the company hashed out a plan for a 30 million electric vehicle rebate. A tax credit on used vehicles worth either 4000 or 30 of the used EVs sales price whichever is lower will be available on used models costing less than 25000.

Tax credits are as. Qualified EVs titled and registered in Colorado are eligible for a tax credit. Colorado EV Incentives for Leases.

Colorado offers its green drivers the following state tax and sales tax incentives. Alternative Fuel Advanced Vehicle and Idle Reduction Technology Tax Credit. Illinois offers a 4000 electric vehicle rebate instead of a tax credit.

Through October 2019 35 Outlander. The credit amount will vary based on the capacity of. Iowa EV tax rebate.

You may qualify for the PTC Rebate if you are a full. Some dealers offer this at point of sale.

Colorado Vehicle Sales Tax Fees Calculator Find The Best Car Price

These Gm Evs Would Be Eligible For Proposed Tax Credit

:focal(939x718:941x720)/electric-car-tax-credit-e769c0c589c549d0a6db66b42821bc0e.jpg)

Decoding The New Electric Vehicle Tax Credits How To Tell If Your Car Qualifies

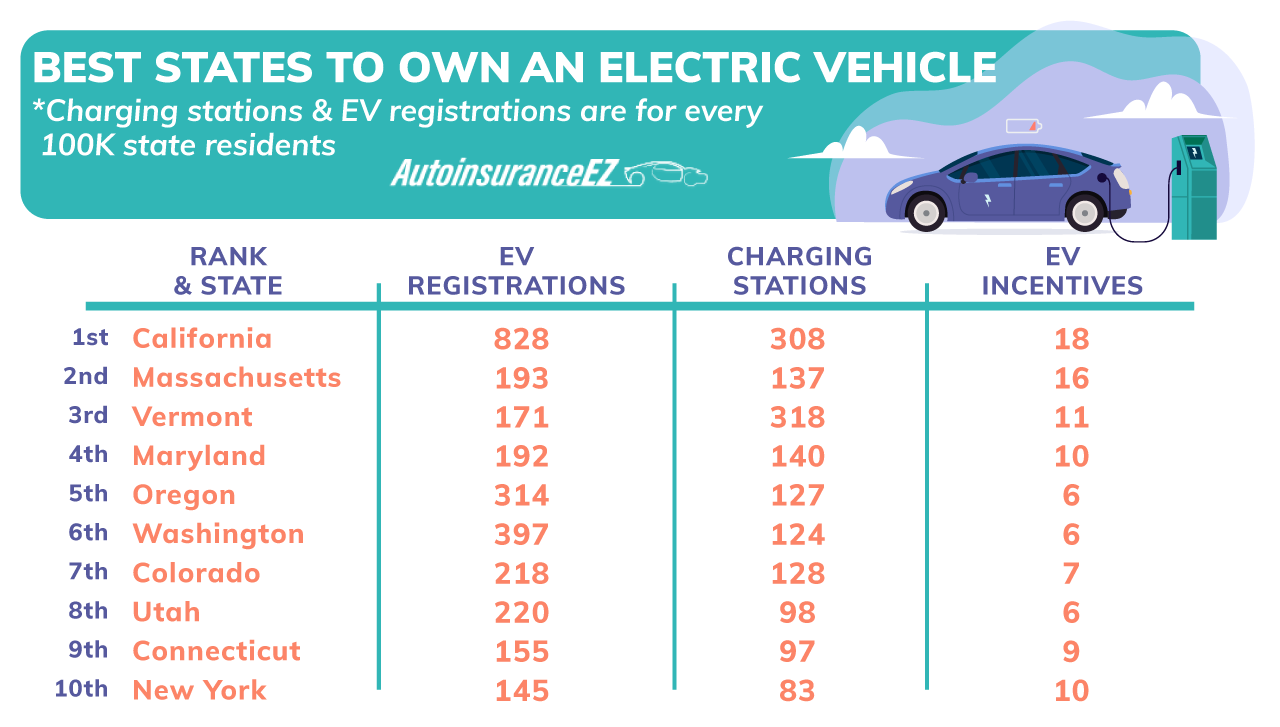

10 Best States To Own An Electric Vehicle 2022 Study Autoinsuranceez Com

What Is An Ev Tax Credit Who Qualifies And What S Next

Electric Vehicle Tax Credit You Can Still Save Greenbacks For Going Green Pkf Mueller

A Complete Guide To The Electric Vehicle Tax Credit

Colorado Approves 5 000 Ev Tax Credit

Ev Tax Credits Manchin A No On Build Back Better Bill Putting 12 500 Incentive In Doubt Cnet

The High Cost Of Electric Vehicle Subsidies Zero Emissions Vehicles

Ev Tax Credits How To Get The Most Money For 2022 Pcmag

New Ev Tax Credits Raise Fear Of A Messy Scenario For Car Dealers Automotive News

Colorado Simplifies Electric Car Incentive But Axes Used Models

Charged Evs Colorado Sweetens Ev Tax Credit Charged Evs

Repeal Of Colorado S Electric Vehicle Tax Credits Passes Republican Controlled State Senate The Denver Post

With Zev Mandate In Effect Colorado Turns Focus To Tax Credits Outreach